Expert CPA Services for Tax-Exempt Organizations in United States

Welcome to M.A.Y Consulting PLLC, your trusted partner for comprehensive CPA services tailored to tax-exempt organizations across the USA. With over Nine years of experience in the field and a background as a tax manager at one of the Big 4 accounting firms, I bring a wealth of expertise and dedication to help your organization thrive. From tax-exempt organization applications to bookkeeping, tax filings, and fundraising event advice, we are here to support the needs of your organizations.

Comprehensive Tax-Exempt Organization Applications

Navigating the complex process of obtaining tax-exempt status can be challenging. At M.A.Y Consulting PLLC, we specialize in preparing and submitting accurate and thorough applications, ensuring your organization meets all IRS requirements. Let us handle the paperwork so you can focus on your mission.

May Chen, CPA, MSA

Founder and Tax Partner – Tax Exempt Organization

May is a Certified Public Accountant in Washington State with over a decade of experience specializing in tax-exempt organizations. She holds a Master of Science in Accounting and a Bachelor of Science in Financial Economics and Mathematics from Binghamton University, State University of New York. Prior to founding her own practice, she served as the Tax-Exempt Organization Manager at Deloitte, where she advised a broad range of charitable entities on complex financial and tax matters.

May’s expertise includes guiding clients through the formation of private foundations and public charities, developing tax-saving strategies, and helping them reinvest those savings into meaningful philanthropic initiatives. She is especially passionate about supporting nonprofits in the fields of art and education.

Beyond her client work, May is committed to community service and regularly provides pro bono support to emerging nonprofit leaders. She is deeply dedicated to advancing the understanding of philanthropy and fostering collaborative efforts that drive long-term impact.

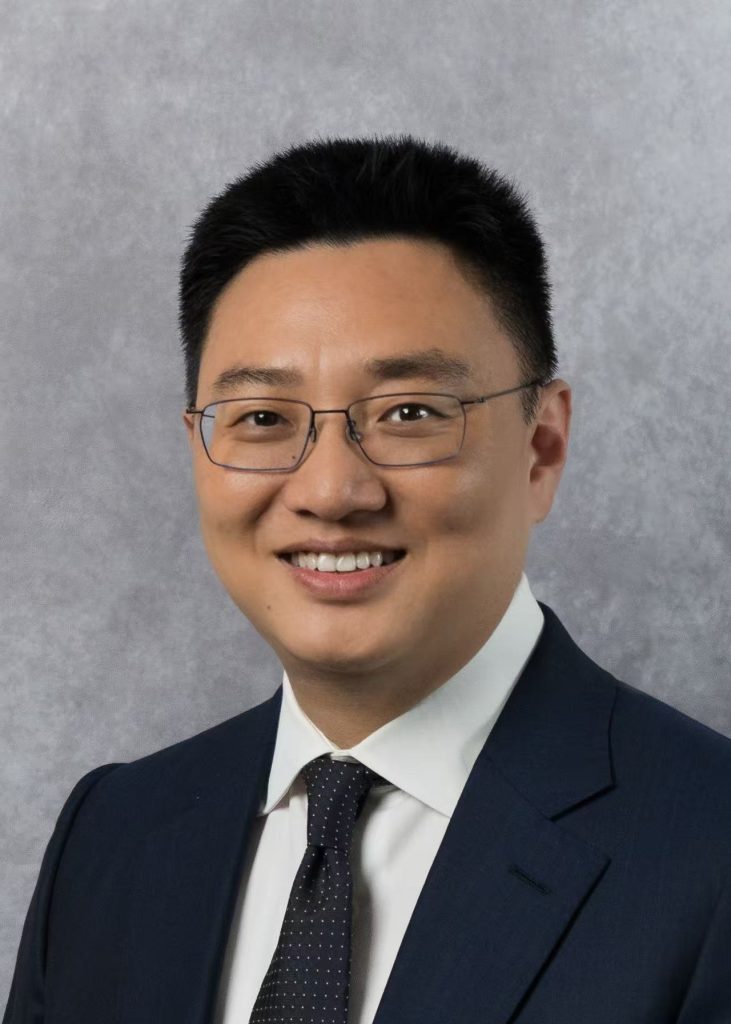

Yu Fan, CPA, MSA

Audit Partner, Tax Exempt Organization

is a Certified Public Accountant licensed in Virginia and Massachusetts, with over a decade of experience specializing in nonprofit auditing, Uniform Guidance compliance, and technical accounting advisory. She has served a wide range of tax-exempt clients across the nonprofit, healthcare, government contracting, and education sectors.

Before joining our firm, Yu was a Senior Advisory Manager at Deloitte, where she provided strategic support to CFOs and Controllers of mission-driven organizations. Her work focused on internal controls, complex accounting matters, SOX readiness, and regulatory compliance. She also developed technical accounting memos, strengthened internal control frameworks, and served as an outsourced controller for organizations navigating complex financial environments.

Yu has led numerous nonprofit audit engagements and brings deep expertise in GAAP, OMB Uniform Guidance compliance, and nonprofit financial reporting. She has also conducted staff trainings and implemented data analytics tools to enhance audit quality and efficiency.

Her combination of audit leadership, regulatory insight, and nonprofit specialization makes her a trusted advisor to organizations seeking excellence in financial governance and compliance.

Harry Yang, JD, LLM

Tax Attorney and Tax Planning Advisor

Harry Yang, JD, LL.M., is an international tax attorney with over 15 years of combined legal and accounting experience. He specializes in advising high-net-worth individuals, entrepreneurs, and family offices on wealth transfer planning, global tax strategy, and cross-border asset structuring. He is licensed to practice law in both New York and Missouri and is admitted to appear before the U.S. Tax Court. Harry is fluent in English and Mandarin.

Harry holds a Juris Doctor (JD) and a Master of Laws in Taxation (LL.M.) from the University of Missouri, as well as a Master’s degree in Wealth Management from Columbia University. His practice focuses on pre-immigration tax planning, international estate structuring, and tax-efficient deployment of global wealth through tools such as trusts, private foundations, retirement assets, and insurance.

Prior to joining our firm, Harry was a Director at PwC, where he served in the Boston, Dallas, and Shanghai offices. He advised U.S. and Asia-Pacific clients on tax planning, family governance, global asset allocation, and tax controversy. He later practiced at Baker McKenzie’s New York office, representing Fortune 500 companies and multinationals in cross-border tax structuring, value chain alignment, and international compliance matters.

Harry also served as Tax Director at Creative Planning, where he counseled ultra-high-net-worth families and business owners, and practiced at Hood Law Group, where he designed international tax structures and successfully represented large Chinese multinationals before the U.S. Tax Court in high-stakes disputes.

Harry’s multidisciplinary expertise in law, tax, and wealth management makes him a trusted advisor to globally mobile families and institutions seeking to preserve and grow wealth across generations.

Testimonials

Consulting, Audit, Tax Planning, and Tax Filing

We offer comprehensive support to tax-exempt organizations, for-profit businesses, and high-net-worth clients through strategic consulting, audit assistance, and tax planning. Our services help both nonprofit and for-profit clients navigate complex regulatory requirements, strengthen internal controls, and make informed financial decisions. For high-net-worth individuals and family offices, we provide tailored strategies to optimize tax outcomes and ensure long-term compliance. We also handle tax filings with precision and timeliness, minimizing risk and maximizing impact.

Accomplished Professionals at Your Service

Certified and Trustworthy Solutions

Focus on Intricate Details

Rapid and Effectual Delivery

Services

Contact

Accelerate your Organization Success with our Consulting Services today!

© 2024 M.A.Y Consulting